Rates

Discount for Prompt Payment of Rates

In accordance with Section 130 of the Local Government Regulation 2012 a discount of 10% will be allowed by Council on the levy for the current year general rates if full payment of current (and any overdue rates, charges and interest) is received by no later than 5:00pm on the due date shown on the rate notice. The due date will be the last day any discount will be allowed, this being a minimum of 31 days from the date of issue of the Rate Notice.

The purpose of this discount is to encourage the prompt payment of the relevant rates and charges. The discount will only apply to general rates and will not be allowed on the State Government’s Fire Services Levy, utility charges, excess water charges or special rates.

To be entitled to the discount, ratepayers must ensure that payment of the levy amount in full net of the discount amount is credited to the Council’s bank account, if done by BPay or electronic fund transfer, or received over the counter at Council’s office, or received by its appointed agents, by 5.00pm on the due date specified on the Rate Notice.

The discount will NOT be allowed on payments received after 5.00pm on the due date applicable to each payment unless Council is satisfied that payment was not made by close of business on the due date due to circumstances for which the Council is responsible.

The discount will also NOT be allowed where a payment was lodged before the close of business on the due date but the transfer of the funds into the Council’s bank account or agent was not received by the close of business on the due date due to any delays by the payer’s financial institution or their agent or other similar reasons.

Discount disallowed on the first instalment of a levy is not eligible for allowance even if payment of a later levy is made by close of business on the specified due date for that levy.

No discount will be allowed if overdue rates/charges remain payable in respect of the property after payment of the current rates/charges.

Interest

Pursuant to the provisions of Section 132 of the Local Government Regulation 2012 Council will charge interest on all overdue rates and charges, including special and separate rates, at the maximum rate provided for by the Regulation.

At Section 133 of the Local Government Regulation 2012, the maximum interest rate applicable is provided.

For the 2024/25 financial year, any outstanding balances at the close of the discount period will incur simple interest at the rate of 12.35% per annum.

Financial Assistance

Rebate of Rates to Pensioners

At Council's discretion, in line with Section 123 of the Local Government Regulation 2012, and Cloncurry Shire Council’s Revenue Statement, a rebate of 20% (to a maximum dollar amount of $200 per annum) of the gross rates and charges levied may be granted to aged, widowed, invalid or other pensioners who are eligible to receive the State Government Pensioner Rate Subsidy. This rebate complements the subsidy that is offered under the State Government’s Pensioner Rate Subsidy Scheme.

In line with State Government concessions, a 20% rebate will also be applied to the Emergency Management Levy (EML) for eligible Pensioners.

The eligibility of a pensioner to receive a Council pensioner rate remission will be determined in terms of the following criteria:

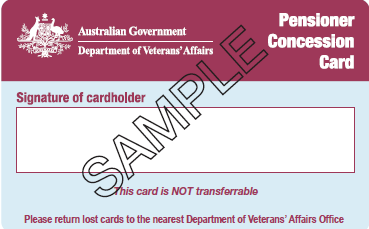

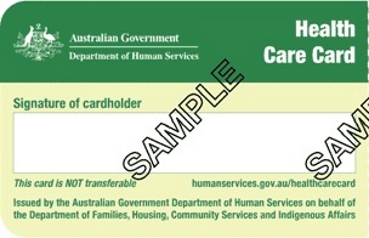

- The applicant/s shall be the holder of a Queensland ‘Pensioner Concession Card’ issued by Centrelink, on behalf of the Department of Communities, or a DVA Health Card (All Conditions within Australia) or DVA Health Card (Totally & Permanently Incapacitated) issued by the Department of Veterans’ Affairs.

- The applicant/s shall be the sole owner/s of the property or life tenants in terms of a valid will. Applicants who are part owners of a property shall receive a concession equal to the portion of ownership.

- The property for which the rate remission is being requested must be the applicant/pensioner’s principal place of residence, which shall not be income-producing in any way. Applicants who, due to ill health or incapacitation, are living in a nursing home or who are temporarily living with relatives or friends, shall qualify for the rate remission, provided the property remains non-income producing.

- The receipt by an eligible pensioner of a pensioner rate remission will not be dependent upon the pensioner ratepayer paying their rates by the due date of payment stated on the Rate Notice.

An application/registration need only be sought from pensioners when:

- Applying for the subsidy for the first time; or

- Council needs to re-establish eligibility (e.g. after having a qualifying concession card re-issued, changing the address of the principal place of residence, etc).

Council acknowledges the policies and procedures of the Queensland State Government Pensioner Rate Subsidy Scheme and ratepayer/s must meet these criteria to be eligible for the Council’s pensioner remission.

If you are eligible for the above rebate, complete the Pensioner Rate Subsidy/Concession Application Form and return to Council for review.

Payment of Overdue Rate by Instalments

To assist ratepayers in meeting their rate responsibilities, Council may accept applications for payment of overdue rates and utility charges by instalments in line with Council’s Rates and Debt Recovery Policy. Any such payment plan which Council agrees to must provide that all rates and charges are to be paid in full within one year from when the application is approved by Council. Each application will be assessed by Council on its merits.

Interest will continue to be charged on overdue rates and utility charges which are subject to an agreed instalment payment plan. The applicant must comply with the terms of the payment plan agreed to, as default will result in Council requiring immediate full payment of future instalments.

To apply for a Payment Plan, complete and return the Payment Plan Application Form and return to Council to begin the approval process.

Concessions

In line with Section 119, of the Local Government Regulation 2012, a concession may be granted by Council for Rates and Charges for land if the required criteria are met. See Section 120 of the Local Government Regulation 2012, for more information.

The types of concessions are as follows:

- A rebate of all or part of the Rates and Charges

- An agreement to defer payment of Rates and Charges

- An agreement to accept a transfer of unencumbered land in full or part payment of the Rates and Charges

If you meet the required criteria for a concession on Rates and Charges, a Financial Hardship Application Form must be completed and submitted with all required documents prior to the concession being considered by Council.

Extreme Financial Hardship

Several options are available to you if you are suffering from extreme financial hardship. Below is a listing of some of your options to assistance with your situation:

- If you have a mortgage, discuss your situation with your mortgagee, as they may be able to pay your Rates and add the amount onto your mortgage.

- Superannuation; if you have any superannuation, you may be able to access your superannuation to pay your Rates. Special conditions apply. Access the Australian Taxation Office website for more information.

- Apply for Queensland Government Mortgage Relief Loan. Other useful information can be found on this website that may assist you.

- Useful links and contacts can be found on our Financial Assistance Information Sheet.

- If eligible, apply for a concession to be considered by Council using our Financial Hardship Application Form

| # | Name | Size | Type | Download |

|---|